Generate carbon credits based on

green energy investments

THE PROBLEM

Why does clean energy need support to deliver real impact?

Achieving national and global climate goals requires a drastic reduction in CO₂ emissions, which can only be accomplished through a large-scale transition to renewable energy. However, despite growing awareness and technological maturity, two major obstacles continue to hinder to unleash the full potential of green energy.

1. Green energy production alone is not enough

While solar, wind, hydro, and other renewable sources offer clean and sustainable alternatives to fossil fuels, their deployment is often limited by economic and practical constraints. Large-scale solar parks or wind farms require significant capital investment, and facing rapidly changing electricity prices, many projects struggle to demonstrate profitability without additional incentives.

Furthermore, while these energy sources are considered as low-carbon based on lifecycle analysis, the impact of their contribution to overall emissions reduction is not always captured or monetized. As a result, developers and investors often miss out on the opportunity to generate additional value from the environmental benefits they provide.

2. Intermittency and grid integration remain critical challenges

Unlike fossil fuels, renewable energy production is not constant, meaning solar depends on sunlight, wind is unpredictable, and hydro also can be seasonal. This intermittency creates major problems for grid stability and leads to situations where excess energy is wasted, or worse, it leads to negative electricity prices undermining the long-term profitability, thus renewable potential is curtailed due to storage limitations.

Without adequate energy storage solutions, even the cleanest energy cannot be fully utilized. The lack of integrated storage infrastructure means that renewable energy is often unavailable when demand is high, resulting in fallback to fossil-based sources effectively undoing the progress made.

In short, while we know how to produce clean energy, we are still failing to capture its full climate impact and financial value due to the insufficient storage capacity.

Looking for a partner who delivers more than just service?

From expertise to execution, we bring clarity, consistency and measurable impact to every climate action project

THE SOLUTION

Carbon credits from renewable energy production

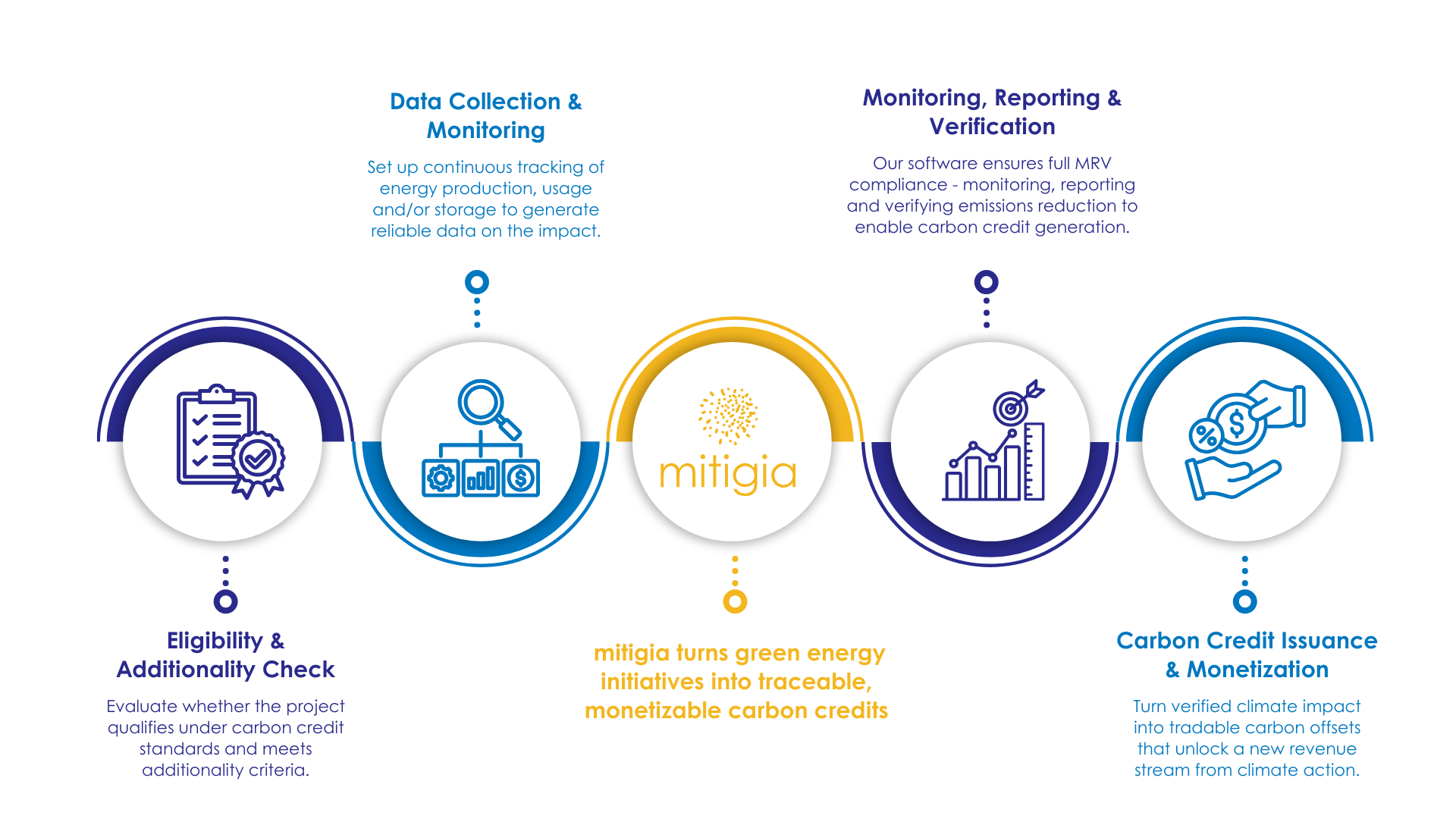

Mitigia provides a scalable, technology-driven MRV solution to address the challenge by turning renewable energy production and storage into carbon credit-generating assets. This allows project developers, manufacturers, and investors to not only reduce emissions, but also create new revenue streams from their climate-positive actions if the project is considered as additional and eligible for crediting.

HOW DOES IT WORK?

The generation process

Carbon credit generation happens automatically via our Digital MRV software designed for quality carbon crediting.

1. Determining the baseline emissions

It starts with the capturing the "dirty power" operation of the underlying electricity grid to be replaced by the renewable electricity project. We calculate the baseline by estimating the avoided carbon footprint as accurately as possible.

2. Determining the project emissions

We accurately determine of the target emissions as the dilution in the carbon footprint of the grid resulting from the project after the green energy has been loaded into it.

3. Verifying the emissions reduction

Determining, reporting and verifying the carbon emission reduction between the baseline and the targeted project emissions.

4. Credit conversion

Having verified by independent 3rd party experts, we generate the Voluntary Carbon Units (VCUs) equal to the resulting verified emissions reductions.

USE CASES

What types of operations are eligible for credit generation?

Renewable Energy Production

Operating solar parks, wind farms, hydroelectric plants, or other installations that generate electricity exclusively from renewable sources.

Energy storage systems

Installing and operating battery storage or other energy storage technologies that store renewable electricity and feed it into the grid when needed, displacing fossil-based energy use.

Looking to turn emissions reduction monetizable offsets?

Email our team — no commitment, just clarity.

VERIFICATIONS

For each of our methodologies

POST FINANCING OF INVESTMENTS IN GREEN ENERGY PRODUCTION BY ISSUING CARBON CREDITS

This verification proves that our know-how is in line with the BSI standards and the GHG protocol, following the recommendations set in the Core Carbon Principles by the Integrity Council for the Voluntary Carbon Market.

Above this it complies with the Monitoring, Reporting and Verification requirements, thus enables our Partners to generate high-integrity carbon credits with their solar or wind power plants.

Date of voluntary registration: 9th July 2024 | No. of carbon market verification: 012417 | No. of carbon market verification: GCH-EMP-80712

Mitigia Carbon Ltd. operated under the name Emprovia Co. Ltd. prior to April 26, 2025.

POST FINANCING OF ENERGY STORAGE INVESTMENTS BY ISSUING CARBON CREDITS

Our carbon credit generation know-how designed for energy storage builders is certified to be in line with the BSI standards and the Quality Grid-balancing Storage Standard, and follows the recommendations set in the Core Carbon Principles by the Integrity Council for the Voluntary Carbon Market.

Above this it complies with the Monitoring, Reporting and Verification requirements, thus enables our Partners to generate high-integrity carbon credits.

Date of voluntary registration: 11th December 2024 | No. of voluntary registration: 013041 | No. of carbon market verification: GCH-EMP-81211

Mitigia Carbon Ltd. operated under the name Emprovia Co. Ltd. prior to April 26, 2025.

Issuing carbon credits with green EV charging networks

Our second methodology, that refers to carbon credit issuance by green electricity powered EV charge points, has been verified by the independent sustainability project auditor, Green Cross Hungary, just like our fleet electrification monetization know-how.

These certifications prove that our know-hows are designed in a way to be line with the BSI standards and the GHG protocol, following the recommendations set in the Core Carbon Principles by the Integrity Council for the Voluntary Carbon Market, and complying with the Monitoring, Reporting and Verification requirements, thus enables our Partners to generate high-integrity carbon credits.