mitigia | carbon credit generation, registry & trading for the green transition of industries

Your one-stop-shop for carbon credit generation & trading.

Your investment. Our know-how. Start generating carbon credits today.

Convenient, 360°carbon credit generation service.

Explore our carbon crediting solutions

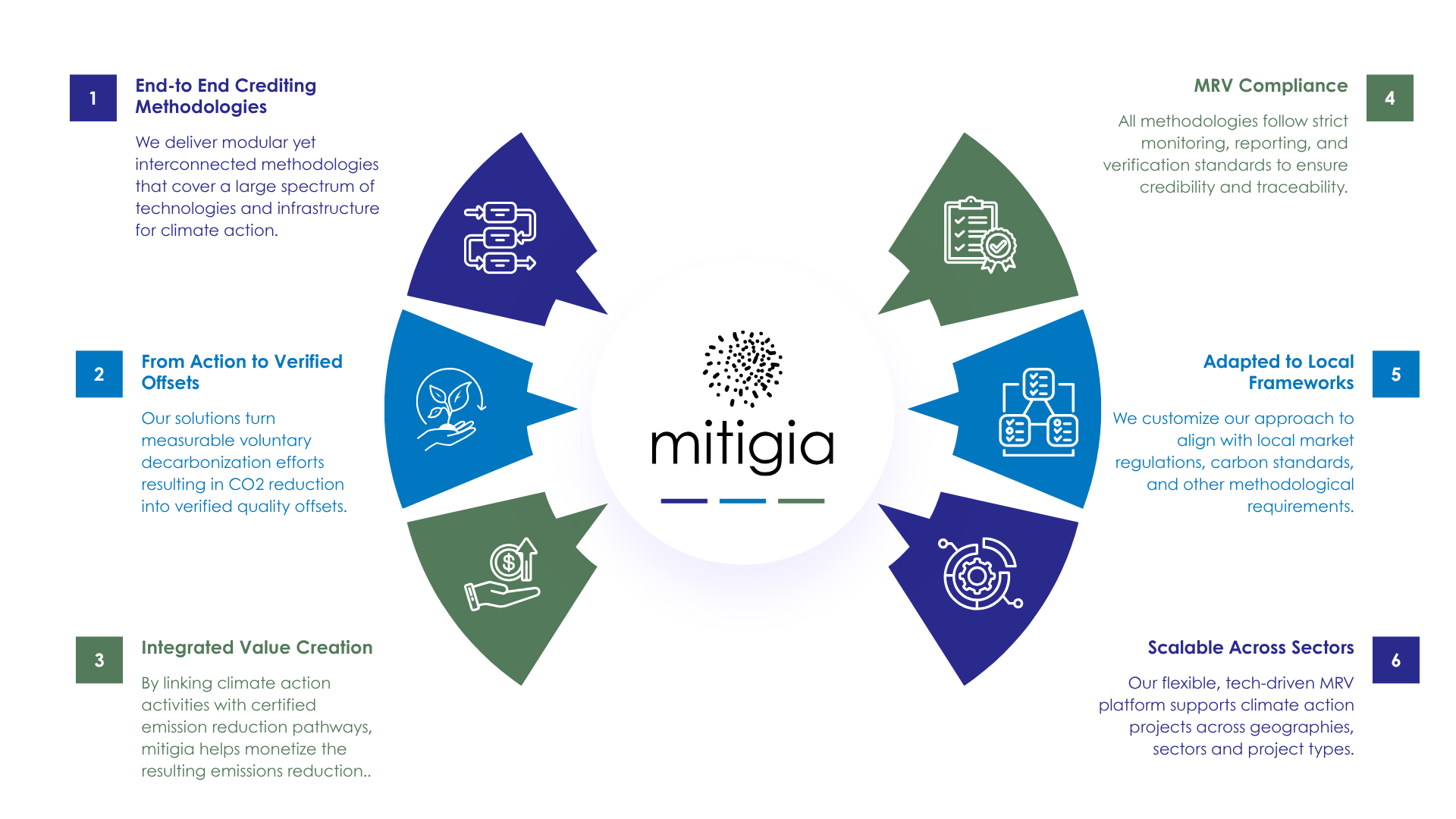

We offer a full suite of professional services covering the creation, registration, and trading of top-notch carbon credits for the purpose of offsetting. Each and every crediting methodology that is facilitated by the digital MRV platform is a result of our patented and tightly verified know-how.

Green investors in the areas of Renewable Energy, E-Mobility, and Recycling, who, by using our crediting solutions, can turn their emission reduction projects into carbon credits that are tradeable with complete transparency and traceability. Therefore, we raise the ROI of green projects by allowing them to monetize the verified emissions reductions (VERs) that result from their activities, at the same time, offering high-quality offsets to credit buyers who wish to neutralize their residual carbon emissions.

Renewable Energy Production & Storage

E-Mobility &

Urban Mobility

Waste Management &

Recycling

They are already benefiting from carbon credits generated by their green investments

Our Clients

Are you interested in carbon crediting?

Book a commitment-free call with our experts!

Our Clients

-

.jpg?width=1920&height=1080&name=j%C3%A1szplasztik%20(1).jpg)

See details by clicking here

-

See details by clicking here

See details by clicking here -

See details by clicking here

See details by clicking here -

.png?width=1920&height=1080&name=id%20energy%20group%20(1).png) See details by clicking here

See details by clicking here -

Credit generation is in progress

Credit generation is in progress -

See details by clicking here

See details by clicking here -

Credit generation is in progress

-

See details by clicking here

-

Credit generation is in progress

Credit generation is in progress -

Credit generation in progress

Credit generation in progress -

Credit generation is in progress

Credit generation is in progress -

Credit generation is in progress

Credit generation is in progress

TRACKING OUR IMPACT

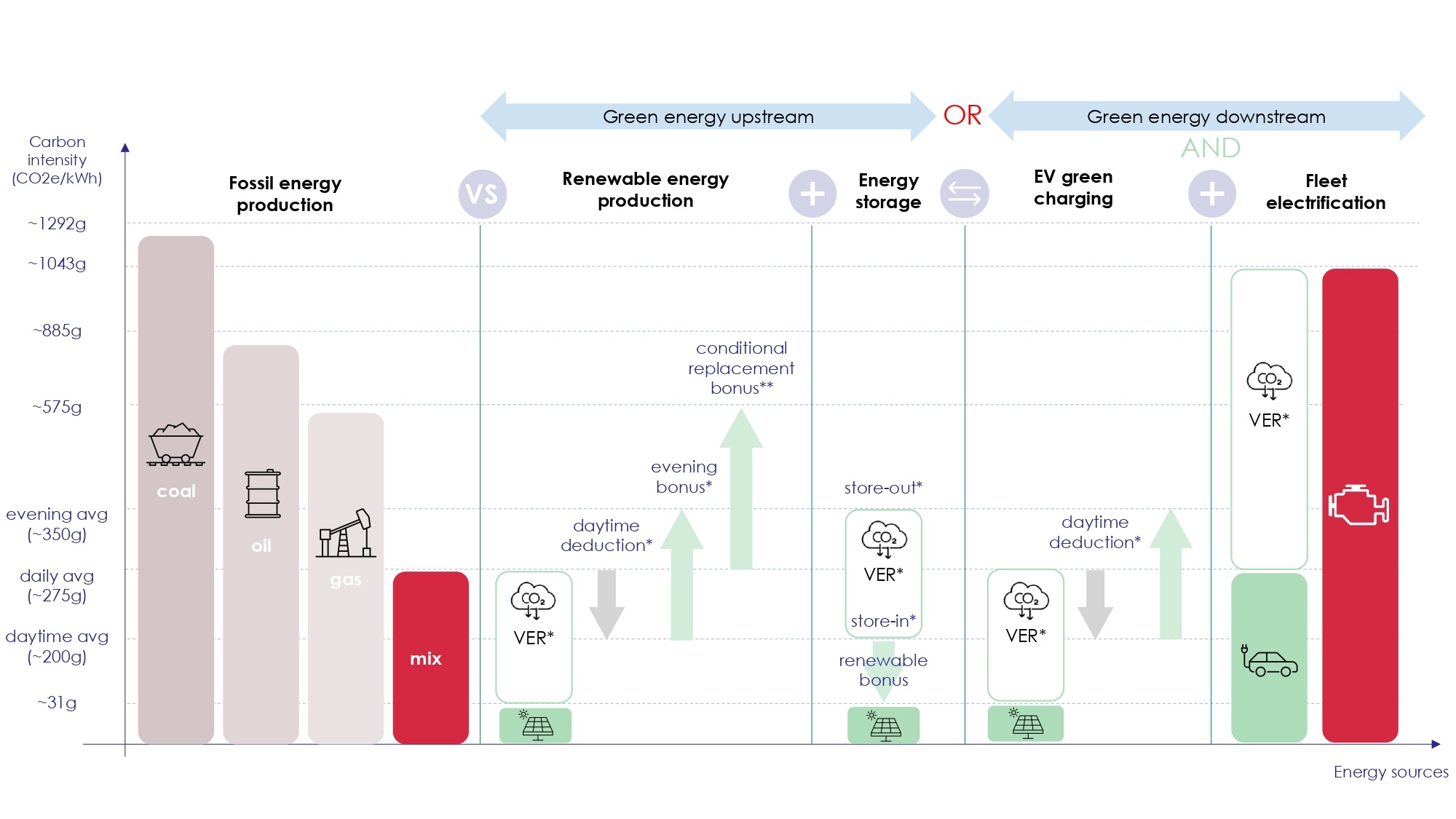

Four main obstacles hinder the spreading of electrification:

the renewable energy production challenge,

the energy storage challenge,

the charging challenge

and last, the EV challenge.

We target all of them with methodologies that built upon each-other.

.png?width=120&name=energy%20storage%20feh%C3%A9r%20ikon%20(1).png)

From technology to verifiable climate finance

Mitigia's methods have been created in such a way that they not only support each other but also cover the whole ecosystems of clean energy, e-mobility, and waste management. Different markets have different procedures for issuing credits which causes these procedures to vary quite significantly from one market to another. These differences result from the regulations, verification standards, and accepted methodologies. Mitigia changes its approach so that it corresponds to the local structures, thus being sure that emission reductions are measured correctly and are completely carbon credit-compatible in the region. Such a level of adaptability is important for the amplification of climate-related measures at different locations and in different industries.

Why we encourage green investors to enter the VCM?

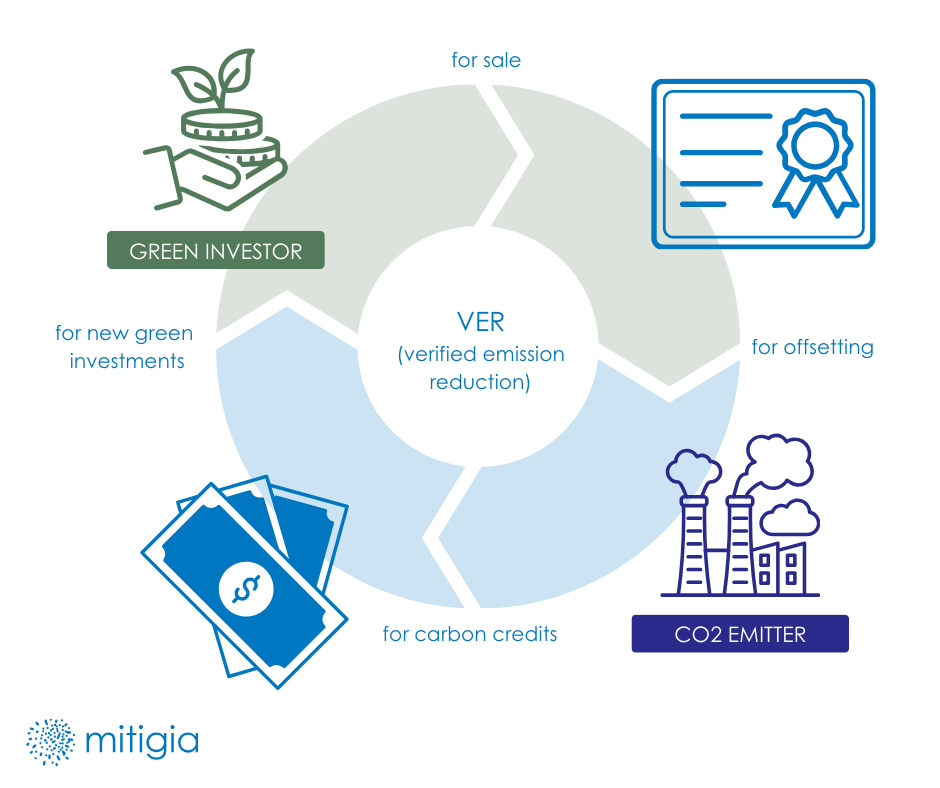

The VCM is a marketplace where carbon credits are being generated from voluntary green investment projects going beyond legal requirements. After scrutiniuous verification they can be sold to CO2 emitters to offset their emissions. Green investment projects involve eg. forest conservation efforts, energy efficiency improvements, as well as swaps towards low-carbon technologies.

When a legal entity purchases carbon credits to offset their emissions, they are also voluntarily contributing to the fight against climate change, by financing these green projects.

In this understanding, the Voluntary Carbon Market encourages the spread of low-carbon innovations, by offering a transparent, reliable offsetting solution for emitters at the same time.

Looking to turn emissions reductions into credits?

Email our team — no commitment, just clarity.

How carbon pricing helps fight climate change?

Carbon pricing is a monetary tool that signals the adverse effects of carbon emissions related to the creation of a product or service - in their price. The amount of the carbon price depends on the damage the production processes cause in the environment or in the society. Carbon taxation, compliance markets (eg. ETS) and the Voluntary Carbon Market (VCM) are all examples of carbon pricing.

The role of the carbon price is to decrease the demand and thus the production volumes of carbon intense products and services, while at the same time serve as a monetary incentive for those investing in climate action. Carbon pricing is in equlibrium when the carbon emissions of human activities reach a level that doesn't risk the sustainability of our planet anymore.

Our methodologies complement each other

...and cover the whole of the electrification ecosystem from renewable energy production to fleet electrification projects.

MONETIZE YOUR EMISSIONS REDUCTIONS

What is a carbon credit?

When you replace a CO2 intense technology with a more climate friendly or even a net zero one, you "spare" CO2 emissions. Thus, you, as an economic entity, realise a so called carbon gain. By comparing the two technologies, the volume of this carbon gain can be precisely measured, verified and reported, and exchanged into Verified Emission Reduction (VER) or Voluntary Carbon Unit (VCU).

What appears as a „spared" or "negative emission” on the green investors' side is sought after by net emitters whose emission volumes exceed the regulatory limits (and cannot avoid or reduce by themselves). These emitters either pay a penalty fee or buy carbon credits in exchange for their emissions. By choosing the second option they turn their ESG obligations into an opportunity to invest in green investments.

mitigia helps green investors originate and register carbon credits based on their electrification investments, and sell such carbon credits to large emitters.

Our know-how is compliant with the requirements of the VCM, thus the carbon credits originated through mitigia’s methodology qualify as high integrity carbon credits.

These credits represent a higher quality for the buyers, who are willing to pay a higher price for the reliability and transparency of the underlying projects the credits were originated from.